尊敬的用户您好,这是来自FT中文网的温馨提示:如您对更多FT中文网的内容感兴趣,请在苹果应用商店或谷歌应用市场搜索“FT中文网”,下载FT中文网的官方应用。

Many one-product companies run out of road. Small plastic bricks have supported Denmark’s Lego for more than 70 years. A clear focus can pay off. But, amid a debate over the health of public markets, its success also demonstrates the benefits of its distinctive corporate structure.

许多只生产一种产品的公司走到了尽头。小塑料积木支撑了丹麦的乐高(Lego)公司超过70年。明确的专注可以带来回报。然而,在公众市场健康状况的争论中,乐高的成功也展示了其独特的公司结构所带来的好处。

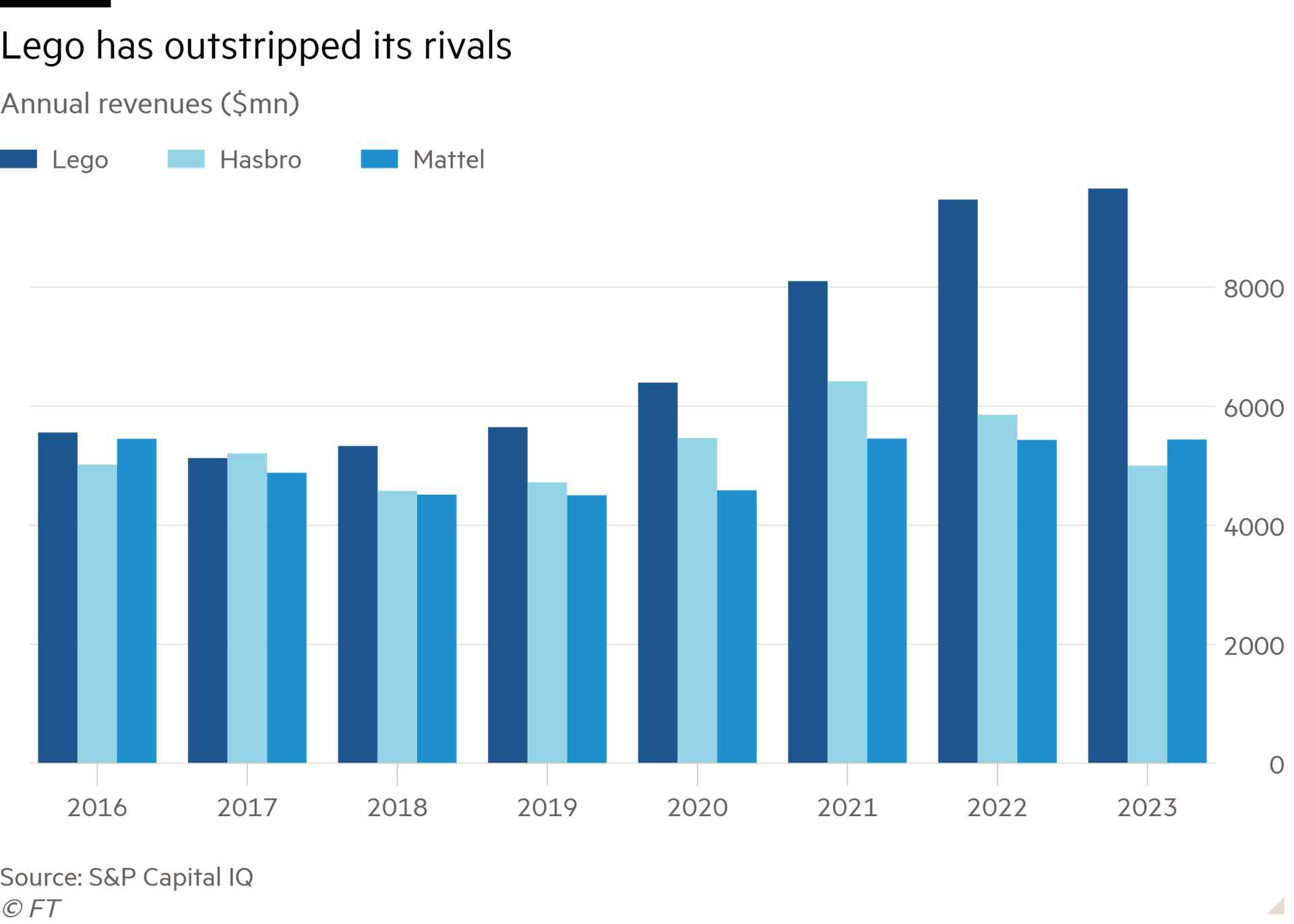

The toymaker’s sales growth of 2 per cent last year was dragged down by a weak performance in China. But it was respectable enough given a seven per cent decline in toy industry sales. Lego’s sales are not much less than the combined total of its quoted US rivals Mattel and Hasbro.

受中国市场表现不佳的影响,玩具制造商乐高去年的销售增长率为2%。然而,考虑到整个玩具行业销售额下降了7%,这个增长率还算可观。乐高的销售额几乎与其美国竞争对手美泰(Mattel)和娱乐集团孩之宝(Hasbro)的总和相当。

Inflation, one cause of the industry’s woes, is subsiding. Low birth rates, another problem, will persist. That is partly offset by adult fans of Lego. This group — known as Afols — creates a market for costly, complicated kits like the Titanic or Eiffel Tower. This “Icons” line made some of the biggest gains of any toy property globally in 2023, according to Circana.

通货膨胀,作为该行业困境的一个原因,正逐渐消退。低出生率,另一持续性问题,仍将存在。这在一定程度上得到了乐高成年粉丝(adult fans of Lego)的部分抵消。这一群体——亦即所谓的Afols——为诸如泰坦尼克号或埃菲尔铁塔等昂贵复杂套装开辟了市场。根据Circana的报告,这一“Icons”系列在2023年成为全球玩具领域增长最快的产品线之一。

New products accounted for roughly half of Lego’s portfolio last year. Innovation isn’t without risk: novelty can damage profitability if it means fewer universal pieces that can be produced in high volumes for lots of different kits. The proliferation of parts contributed to Lego’s downturn in 2003, says academic David Robertson. However, the business has since expanded so it can use more parts without hurting the ratio of sales to profits.

去年,新产品大约占了乐高总产品的一半。创新并非没有风险:如果新颖性导致可以大量生产并适用于众多不同套装的通用零件数量减少,那么这可能会对盈利能力产生负面影响。学者大卫•罗伯森(David Robertson)表示,零件数量的增加是乐高2003年经营低迷的原因之一。然而,乐高已经扩大了业务规模,因此可以使用更多的零件,而不会影响销售和利润的比例。

Lego’s operating profit margin fell by 1.7 per cent to 26 per cent, as it spent more on stores, its supply chain and digital operations. Even so, that is nearly three times Hasbro’s adjusted operating figure. Were it quoted, Lego would be worth much more than the $43bn estimate arrived at by using Hasbro’s trailing EV-to-ebitda ratio of 15.5 times.

乐高的营业利润率下降了1.7个百分点,降至26%,这主要是由于其在商店、供应链和数字化运营上的投入增加。然而,这个数字仍然是孩之宝调整后的运营数据的近三倍。如果乐高上市,按照孩之宝过去的EV/EBITDA比率15.5倍计算,乐高的市值将远超过430亿美元的估值。

But Lego is privately held and there is no sign of that changing. Kirkbi, an investment vehicle run by the founding family, owns 75 per cent, with the remainder owned by the Lego Foundation. When an heir opted to sell some Kirkbi shares for $930mn last year, family members took up the slack. Outside investors’ only exposure to the brand is through Legoland-owner Merlin Entertainments. Blackstone and Canadian pension fund CPPIB teamed up with Kirkbi on the £6bn take-private bid in 2019.

但乐高是私人持有,且没有任何迹象显示这将会改变。由创始家族运营的投资机构Kirkbi持有75%的股份,其余由乐高基金会(Lego Foundation)所有。去年,当一位继承人选择以9.3亿美元的价格出售部分Kirkbi股份时,家族成员接手了这部分股份。外部投资者接触该品牌的唯一方式是通过乐高乐园的所有者——默林娱乐公司(Merlin Entertainments)。黑石集团(Blackstone)和加拿大养老基金CPPIB在2019年与Kirkbi联手,进行了60亿英镑的私有化收购。

External investors might have been less inclined to tolerate last year’s 10 per cent dividend cut to fund investment. There is evidence that tightly held companies like Lego benefit from a long-term perspective. Building the business, like its product, is an exercise in patience. It can yield impressive results.

去年为了筹集投资资金而削减了10%的股息,外部投资者可能较不愿意接受。有证据显示,像乐高这样的严格控股公司能从长期视角中受益。建立业务,就像其产品一样,需要耐心。这样做可以产生令人印象深刻的成果。