尊敬的用户您好,这是来自FT中文网的温馨提示:如您对更多FT中文网的内容感兴趣,请在苹果应用商店或谷歌应用市场搜索“FT中文网”,下载FT中文网的官方应用。

There are five days to go, but even the

best coverage of the US presidential election cannot give us any sense of which way things will go. If you believe the polls, the race is a dead heat. If you believe the so-called prediction models, Donald Trump is slightly more likely to win than Kamala Harris.

还有五天时间,但即使是

对美国总统大选最精彩的报道,也无法让我们对局势的走向有任何判断。如果你相信民意调查,那么选情将势均力敌。如果你相信所谓的预测模型,唐纳德•特朗普(Donald Trump)获胜的可能性略高于卡玛拉•哈里斯(Kamala Harris)。

I believe neither. I decided to treat polls as uninformative after the 2022 midterm elections, where many people whose judgment on US politics I trust more than mine took the polls to show a “red wave”. It didn’t happen, and I have seen no totally convincing explanation as to why that would make me trust US political polls again. (

My own attempt to make sense of this concluded that not just abortion, but the economy counted in Democrats’ favour — on which more below.) The 2022 failure came on top of the poll misses in 2016 and 2020.

我两者都不相信。2022年中期选举后,我决定将民调视为不具参考价值的信息,因为许多我比我更信任的人对美国政治的判断认为民调显示会出现“红色浪潮”。但这并没有发生,我也没有看到任何完全令人信服的解释,能让我再次相信美国的政治民调。2022年的失败是在2016年和2020年民调失利的基础上发生的。

Not that I’m less of a poll junkie than the next journalist. Polls are captivating in the way that another hit of your favourite drug is, as my colleague Oliver Roeder suggests in his

absolute must-read long read on polling in last weekend’s FT. And, of course,

pollsters have been thinking hard about how they may get closer to the actual result this time. But none of this makes me think it’s wise to think polls impart more information beyond the simple fact that we don’t know.

并不是说我比其他记者更不迷恋民意调查。正如我的同事奥利弗•罗德(Oliver Roeder)在上周末的英国《金融时报》上发表的

关于民调的必读长篇文章中所说,民意调查就像你最喜欢的毒品一样令人着迷。当然,民调机构一直在努力思考这次如何更接近实际结果。但这一切都没有让我觉得,除了“我们不知道”这一简单事实之外,认为民调还能传递更多信息是明智的。

So-called prediction models are worse, because they claim to impart greater knowledge than polls, but they actually do the opposite. These models (such as

538’s and

The Economist’s) will tell you there is a certain probability that, say, Trump will win (52 per cent and 50 per cent at this time of writing, respectively). But a probability distribution is not a prediction — not in the case of a one-time event. Even a more lopsided probability does not “predict” either outcome; it says both are possible and at most that the modeller is more confident that one rather than the other will happen. A nearly 50-50 “prediction” says nothing at all — or nothing more than “we don’t know anything” about who will win in language pretending to say the opposite. (Don’t even get me started on betting markets . . . )

所谓的预测模型更糟糕,因为它们声称比民意调查传授更多的知识,但实际上却恰恰相反。这些模型会告诉你,特朗普获胜的概率是一定的

For something to count as a prediction, it has to be falsifiable, and probability distributions can’t be falsified by a single event. So in the case of the 2024 presidential election, look for those willing to give reasons why they make the falsifiable but definitive prediction that Trump wins, or Harris wins (or, conceivably but implausibly, neither).

要将某事视为预测,它必须是可证伪的,而概率分布无法通过单一事件来证伪。因此,在2024年总统大选中,寻找那些愿意给出理由的人,解释他们为何做出特朗普获胜或哈里斯获胜(或者,可以想象但难以置信的是,两者皆不)这一可证伪但明确的预测。

At this point, it’s entirely fair to ask what I predict. From everything I have said so far, I will happily admit that I don’t know anything about who will win. But over the course of many columns, I have made some intellectual commitments, which have implications for what I should think will happen if predict I must do. So it’s time to stick my neck out.

在这一点上,问我的预测是完全合理的。根据我迄今为止所说的一切,我乐于承认我对谁会获胜一无所知。然而,在许多专栏中,我已经做出了一些理智上的承诺,这些承诺会影响到我在必须做出预测时应该认为会发生的事情。所以,现在是时候冒险一试了。

I predict that Harris will win, and by a solid margin. Why? Largely because I think “it’s still the economy, stupid” that determines the election — and because I think the strength of the US economy is more appreciated by US voters than the electoral polling picks up. (In addition, I think the abortion issue that helped Democrats outdo expectations two years ago is, if anything, stronger today.)

我预测哈里斯将获胜,而且会以明显的优势获胜。为什么?主要是因为我认为“决定选举的仍然是经济,傻瓜”,而且我认为美国选民对美国经济实力的认可程度要高于选举民调所反映的。

The

puzzle around the mismatch between

strong economic outcomes (real wage growth, a strong job market, an industrial boom) and lack of support for the incumbent in electoral polling can be solved in two ways: questioning the economic data or the electoral poll results. Most observers have tried to find fault with the notion that the economy is good. For example, it’s easy to point out that while inflation has abated, prices are still a lot higher than before it took off; or that high interest rates weigh on many families’ prospects for buying a house. But there is an element of reverse engineering to this, seeking out the negatives that would explain the seeming lack of impact from a strong economy.

围绕强劲的经济成果(实际工资增长、强劲的就业市场、工业繁荣)与选举民调中缺乏对现任者的支持之间的不匹配问题,可以通过两种方式解决:质疑经济数据或选举民调结果。大多数观察家都试图质疑经济良好的说法。例如,很容易指出,虽然通胀有所缓解,但物价仍然比通胀起飞前高出许多;或者高利率影响了许多家庭的购房前景。但这其中也有逆向工程的因素,即寻找负面因素来解释为何强劲的经济似乎没有产生影响。

So I find it more plausible to question the electoral polls. That is only partly because of polling’s recent failures. It’s also because a lot of voters actually do seem happy with the economy.

Properly adjusted for methodological changes, the Michigan consumer sentiment index has been on a clear upward trend since inflation peaked in the summer of 2022, and has reached levels similar to those four years ago. The

Conference Board’s measure of consumer confidence, too, has picked up fairly strongly.

因此,我认为质疑选举民调更有道理。这不仅仅是因为民调最近的失败,还因为许多选民实际上似乎对经济感到满意。

经过适当的方法调整后,密歇根消费者信心指数自2022年夏季通胀达到峰值以来一直呈现明显的上升趋势,并已达到与四年前相似的水平。世界大型企业联合会(Conference Board)的消费者信心指数也有相当强劲的回升。

Alert readers might at this point rightly ask why I trust these surveys if I don’t trust the electoral polling. And I wouldn’t have a convincing answer — beyond pointing out that, unlike past electoral polls, sentiment surveys have largely tracked the economic reality, and returned the highest scores when labour markets have been strong, inflation low and real wages growing. I would also point to my colleague Robert Armstrong’s wonderful

write-up of his visit to the mall where he observed that whatever they may say, Americans consume as if times are good (their consumption powered another

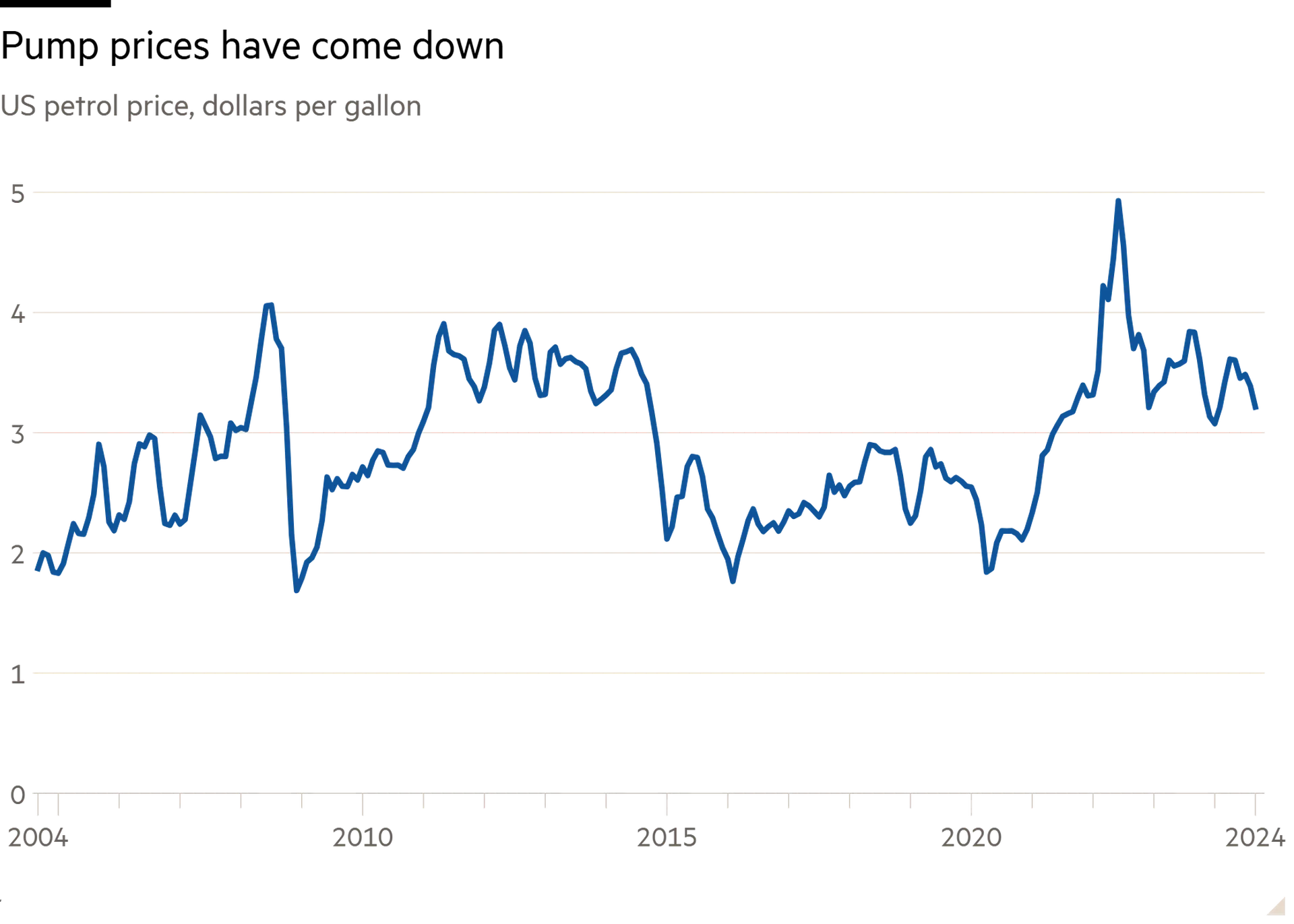

strong quarter of growth in data released on Wednesday). And, above all, the facts speak for themselves, including those that have always been the most salient in US voter behaviour. Here is the petrol price — in nominal terms:

此时此刻,警觉的读者可能会问,既然我不相信选举民调,为什么还要相信这些调查呢?我没有一个令人信服的答案,只能指出,与以往的选举民调不同,情绪调查在很大程度上反映了经济现实,并在劳动力市场强劲、通胀率低、实际工资增长时得分最高。我还想提到我的同事罗伯特•阿姆斯特朗(Robert Armstrong)

撰写的一篇精彩文章,他在访问购物中心时观察到,无论他们怎么说,美国人的消费行为表明经济状况良好(在周三发布的数据中,他们的消费推动了又一个季度的强劲增长)。最重要的是,事实胜于雄辩,包括那些在美国选民行为中一直最为突出的事实。以下是名义汽油价格:

And here it is expressed in terms of working hours it would take at an average wage to buy a gallon of petrol:

这里用平均工资来计算购买一加仑汽油所需的工作时间:

There can, in other words, be little doubt that a lot of Americans are better off than four years ago. I hold on to the belief that this will in the end play out in the vote.

换句话说,几乎可以肯定,许多美国人的生活比四年前要好。我坚信,这最终会在投票中体现出来。

Sketching this argument out to a colleague, I was asked if this isn’t wishful thinking. Which of course it is. But it is wishful thinking again linked to some specific intellectual commitments set out in the columns I have devoted to “Bidenomics”, the novel economic policy approach of President Joe Biden’s team, and similar economic arguments. As Nicholas Lemann writes in a

terrific piece in the New Yorker: “The irony of Bidenomics is the vast gulf between its scale — measured in money and in the number of projects that it has set in motion — and its political impact, which is essentially zero, even though a major part of its rationale is political.”

我向一位同事概述了这一论点,他问我这是不是一厢情愿。这当然是一厢情愿。但这又是一厢情愿的想法,与我在“拜登经济学”专栏中阐述的一些具体的思想承诺有关,这些专栏探讨了乔•拜登(Joe Biden)总统团队的新颖经济政策方针,以及类似的经济论点。正如尼古拉斯•莱曼(Nicholas Lemann)

在《纽约客》(New Yorker)杂志上发表的一篇精彩文章中所写:“拜登经济学的讽刺之处在于其规模——以资金和已启动项目的数量来衡量——与政治影响之间的巨大鸿沟,尽管其主要理论依据是政治性的,但政治影响基本上为零。”

That rationale is one I have written supportively about since before Biden’s presidency. Indeed I wrote a

whole book about how a new “economics of belonging” is what it would take to draw voters away from illiberal and anti-democratic populism. So I

welcomed the big changes Biden presided over, and agree with how Lemann describes them today:

自拜登担任总统之前,我就曾撰文支持这一观点。事实上,我写过

一本完整的书,论述新的“归属经济学”如何能够吸引选民远离不自由和反民主的民粹主义。因此,我

对拜登主持的重大变革表示欢迎,并同意莱曼今天的描述:

Objectively, and improbably, he has passed more new domestic programs than any Democratic president since Lyndon Johnson — maybe even since Franklin Roosevelt . . . Biden passed domestic legislation that will generate government spending of at least five trillion dollars, spread across a wide range of purposes, in every corner of the country. He has also redirected many of the federal government’s regulatory agencies in ways that will profoundly affect American life . . . All of this doesn’t represent merely a hodgepodge of actions. There is as close to a unifying theory as one can find in a sweeping set of government policies. Almost all the discussion of “Bidenomics” — by focusing on short-term fluctuations of national metrics such as growth, the inflation rate, and unemployment, with the aim of determining the health of the economy — misses the point. Real Bidenomics upends a set of economic assumptions that have prevailed in both parties for most of the past half century. Biden is the first president in decades to treat government as the designer and ongoing referee of markets, rather than as the corrector of markets’ dislocations and excesses after the fact.

客观地说,他通过的新国内项目比任何一位自林登•约翰逊(Lyndon Johnson)以来的民主党总统都要多,甚至可能比自富兰克林•罗斯福(Franklin Roosevelt)以来的任何一位民主党总统都要多。拜登通过的国内立法将导致至少五万亿美元的政府支出,这些支出分布在全国各地,涉及广泛的用途。他还重新调整了许多联邦政府的监管机构,这将深刻影响美国人的生活。所有这些不仅仅是各种行动的杂烩。在一系列广泛的政府政策中,可以找到最接近统一的理论。几乎所有关于“拜登经济学”的讨论都忽略了一个重点,即关注经济增长、通货膨胀率和失业率等国家指标的短期波动,以判断经济健康状况。真正的“拜登经济学”颠覆了过去半个世纪以来两党普遍接受的一系列经济假设。拜登是数十年来第一位将政府视为市场的设计者和持续裁判者的总统,而不是事后纠正市场失调和过度的总统。

Wishful thinking, then, insofar as I have long argued that this sort of economics should bear political fruit. And wishful thinking in one other way: although it has been a while since I lived in the US, my more than a decade there still makes me believe that there are enough voters in enough states who find the spectacle of a new Trump presidency off-putting to secure a Harris victory. Tuesday will put my confidence to the test on both counts.

那么,就我长期以来认为这种经济学应该结出政治果实而言,这是一厢情愿的想法。另一方面,这也是一厢情愿的想法:尽管我已经有一段时间没有在美国生活了,但我在那里的十多年经历仍然让我相信,在足够多的州,有足够多的选民会觉得特朗普再次当选总统的景象令人反感,从而确保哈里斯的胜利。星期二将考验我在这两方面的信心。

Other readables

其他可读内容