Exchange traded fund investors pumped record sums into fixed income and “quality” stocks last year as risk appetite jumped in the final months of 2023.

However inflation-linked bond funds and broad commodity ETFs experienced record outflows as sliding global inflation tempered investors’ desire to hedge against its corrosive effect on asset prices.

Overall, the global ETF industry recorded net inflows of $965bn last year, according to data from BlackRock, up from $867bn in 2022. This was the second-highest figure on record, behind 2021’s $1.3tn.

“It’s interesting to see it compare to 2021, even though we had so many rate hikes,” said Karim Chedid, head of investment strategy for BlackRock’s iShares arm in the Emea region, referring to the fact that tighter monetary policy tends to weigh on equity and bond prices.

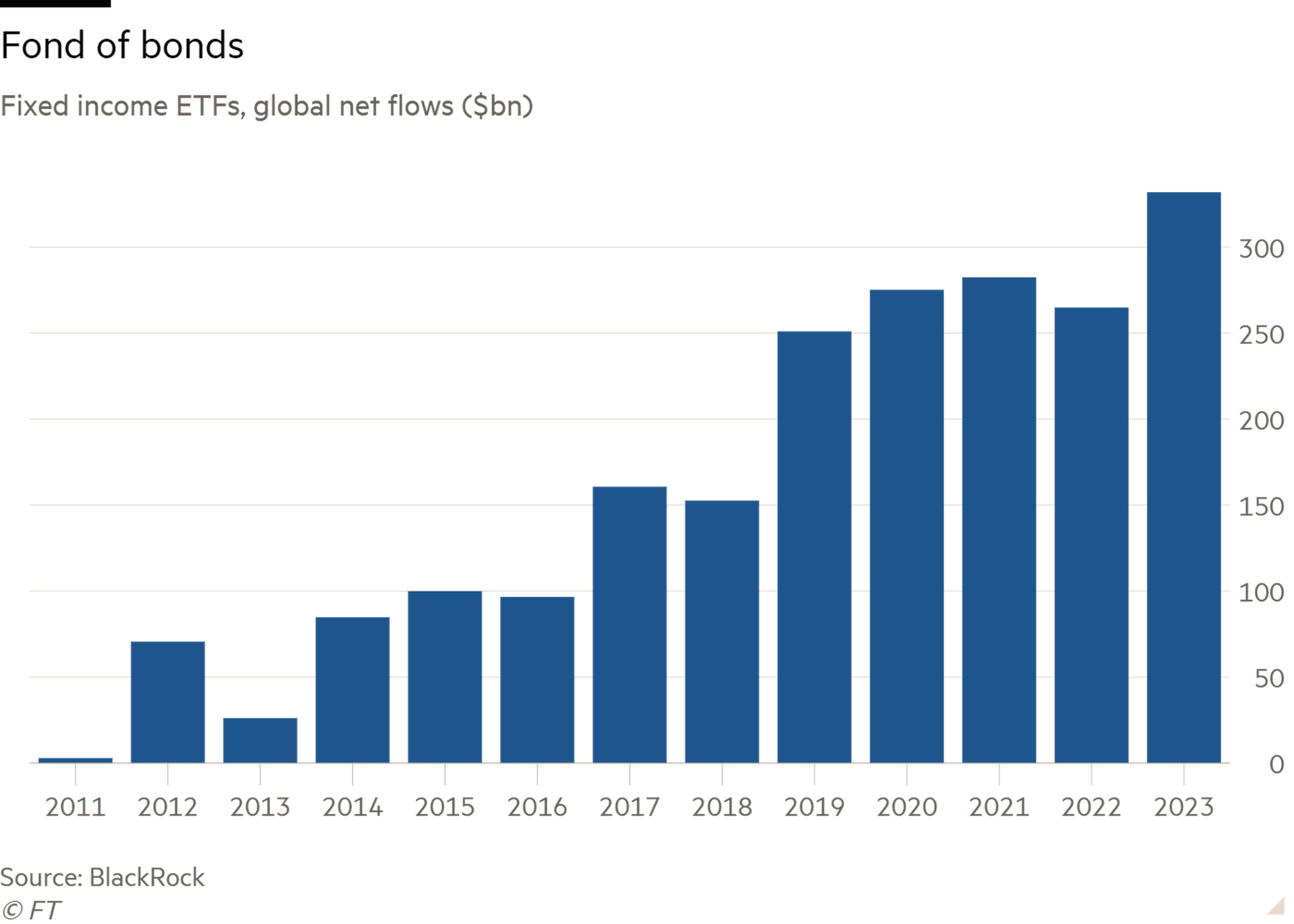

Unlike 2021 and 2022, when equity funds dominated, ETF flows were more balanced last year. Stock funds sucked in a net $640bn, below the $1tn of 2021, but fixed income ETFs vacuumed up a record $332bn, surpassing the previous zenith of $282bn in 2021.

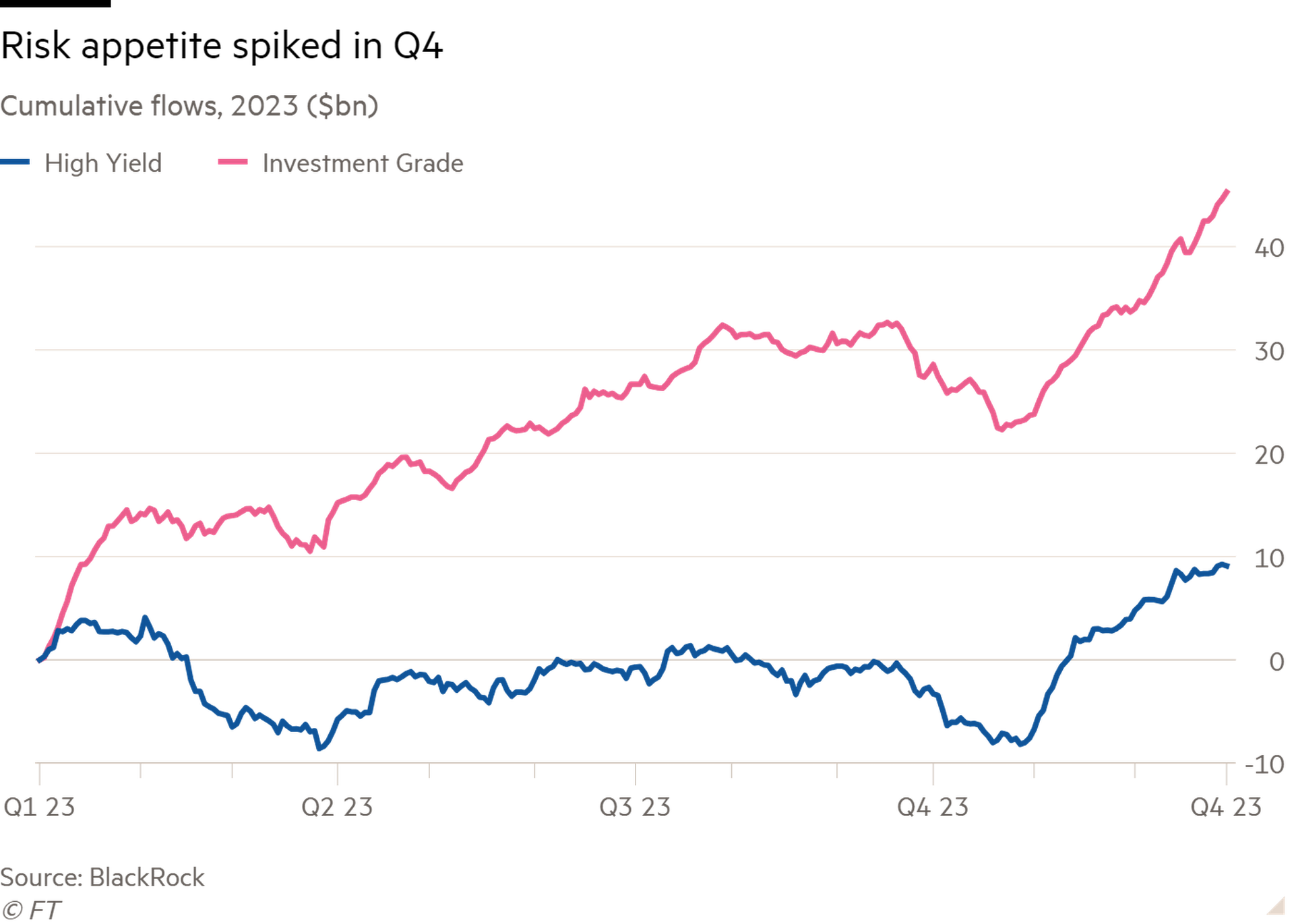

Fixed income’s record year was capped by a sharp pick-up in risk appetite in the final quarter. Flows into sovereign bond ETFs, which had dominated earlier in the year, fell to $31.9bn in Q4, their lowest figure since Q1 2022.

However riskier corporate bond flows spiked to $29.1bn in the quarter. The volte-face was particularly notable in high-yield bonds, which saw year-to-date net outflows of $8bn as of October 27, but then took in $17.1bn in the remainder of 2023.

Chedid said investors were “locking in higher yields” before they started to slide in line with inflation and interest rate expectations.

Todd Rosenbluth, head of research at VettaFi, a consultancy, saw the scope for more buying to come.

“We are still in the early stages of fixed income [ETF] adoption globally,” he said. “Investors embraced fixed income ETFs in a rising rate environment and returns are likely to be better in 2024 if, as expected, the US Federal Reserve begins and continues to cut interest rates.”

The “everything rally” in the fourth quarter also bolstered equity ETFs. Those focused on US equities enjoyed their highest inflows on record in the fourth quarter, $197bn, helped by December’s record monthly tally of $97.2bn. Higher-risk emerging market equity ETFs saw their third-best month ever, taking in $22.3bn, the BlackRock data show.

Sector-wise, 2023 was all about technology ETFs, which garnered $52.2bn, a light year away from the second most popular sector, financials, with $3.8bn.

In terms of investment “factors”, quality — stocks with a high return on equity, stable earnings growth and low leverage — ruled the roost, with a record $36bn of net buying.

As a result, the iShares MSCI USA Quality Factor ETF (QUAL) was in the top 10 of US-listed ETFs by flows last year, with $11.1bn, Rosenbluth said, as quality stocks “did well in an uncertain economic environment”. QUAL returned 30.9 per cent last year, beating the S&P 500 by 4.6 percentage points.

Funds targeting cheaper “value” stocks amassed just $5.3bn, the lowest reading for four years, while minimum volatility ETFs bled $16.4bn.

ETFs investing on the basis of environmental, social and governance concerns also drifted out of favour. Even in their European heartland, they only accounted for 29 per cent of ETF inflows last year, compared with 61 per cent in 2022, according to Invesco.

Also in the doghouse were inflation-linked bond ETFs, which haemorrhaged a record $20.7bn, as waning inflation eroded their appeal.

The iShares TIPS Bond ETF (TIP) alone shipped $4.5bn, Rosenbluth said, as investors “were less apt to protect against an inflationary environment in 2023”.

Slowing inflation may also have been a factor in the continued travails of commodity exchange traded products, which lost $15.4bn, their third straight year of outflows. Gold funds accounted for the bulk of this, shipping $13.5bn, the second-worst tally ever, while broad commodity vehicles shed $3bn, an all-time high.

“Given gold’s positive performance, this trend of under-allocating could be considered a missed opportunity by ETF investors,” said Matthew Bartolini, head of SPDR Americas research at State Street Global Advisors.

Chedid compared gold to value stocks, in that both tended to draw money during inflationary periods, but was nevertheless surprised by the unpopularity of gold ETPs, given the price rose 13 per cent last year. “The correlation between the two has broken down,” he said.

Chedid saw reasons to believe the bullish environment could continue into 2024.

“The risk rally has further legs to go if you consider there is a lot of cash on the sidelines that can be deployed,” he said, with safety-first money market funds attracting nearly $2tn last year, pushing their assets to $8tn, while in Europe average cash allocations in wealth portfolios have risen from 3 per cent in 2021 to 8 per cent.

Rosenbluth was also upbeat, but expected a stock rotation. “I do think we are going to see great demand and strong performance for value investing. [These stocks] tend to do better in a falling interest rate environment. Financials, consumer staples and energy are favoured in value strategies,” he said.

However Chedid warned that BlackRock’s house view is that the six interest cuts priced in for the US this year are “excessive”.

“We are not in the camp that inflation will come down nicely. Labour supply is tight in the US,” he said.

More broadly, “from a macro perspective it’s hard to argue that there won’t be any volatility this year,” which central banks may be unable to help out with, unlike in the days of quantitative easing.

“That’s the headwind for the risk rally that we saw in Q4,” Chedid said.

Bartolini shared these concerns. “US equity markets, the engine behind the surge in global stock returns, enter 2024 with stretched valuations,” he said. “And geopolitical risks are likely to intensify, given 76 countries will hold elections in 2024.”