Should fossil fuel and industrial companies spend billions trying to build new, “cleaner” businesses? Or simply squeeze as much cash as possible from existing operations, even if they are in structural decline? This is one of the defining questions of the decade in many sectors.

Successful case studies backing up option A are becoming fewer and farther between. The 207-year-old British industrial group Johnson Matthey’s latest transformation shows how well-meaning ideas can turn into expensive misfires — as well as the dangers of becoming a “jam tomorrow” energy transition stock.

Standard Investments, Johnson Matthey’s largest shareholder, on Monday attacked the group for spending “significant capital” on “unproven” growth businesses. It is not hard to see why the group is coming under pressure: it trades about a fifth lower than rivals on a forward EV/ebitda basis on FactSet data.

Johnson Matthey is known for its catalytic converter business, which is still highly cash generative, despite pressures on the auto sector. Indeed, the company has said the division will generate at least £4.5bn of cash in the decade to 2031, £2bn of which has already been delivered.

Trouble is, catalytic converters should — over time — become obsolete as consumers switch from combustion engines. Liam Condon, who took over as chief executive in 2022, has hence pursued a strategy which relies, in part, on a bet that other technologies, such as “clean” hydrogen, will take off.

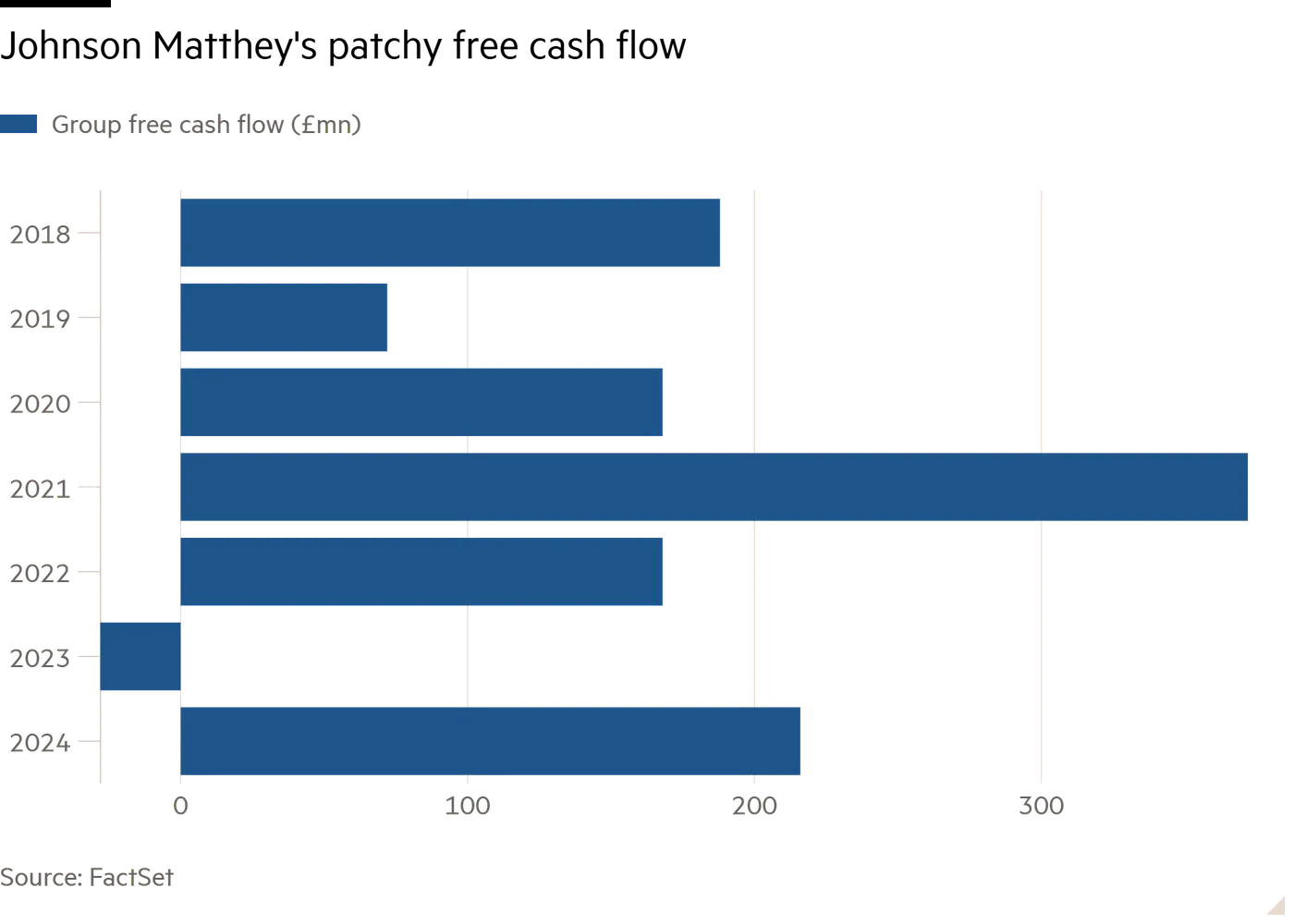

This involves substantial upfront investment. Excluding disposals, Johnson Matthey’s underlying business has since April 1 2021 burnt £135mn of cash, on Standard’s estimates. Growth businesses aren’t solely to blame: Johnson Matthey is also investing in its traditional businesses, including building a more efficient refinery in China for critical materials including platinum.

The hydrogen division — which makes components for fuel cells and electrolysers — has consumed £310mn of cash since the 2022 fiscal year, says Standard. That’s a concern given the clean hydrogen industry is faltering.

Johnson Matthey may be hoping that shareholders will be willing to wait and see. Already, it has taken steps to stabilise the ship. It has delayed the start of production at a UK hydrogen components factory. Overall group capex, which totalled £1.1bn in the past three years, should reduce to £900mn over the next three. Cash flow generation should stabilise, reckons Panmure Liberum’s Lacie Midgley.

The problem is shareholders have already been burnt by Johnson Matthey’s expensive foray into cathodes for electric vehicle batteries under previous management, which resulted in a £363mn impairment and restructuring charge.

As others such as BP know only too well, patience is wearing thin with “cash tomorrow” energy transition promises — no matter how visionary the strategy.